38+ can you deduct your mortgage interest

Mortgage 1 has helped thousands of. Web To better understand whether you can deduct your mortgage interest and other mortgage costs from your taxes talk to your tax professional.

Maximum Mortgage Tax Deduction Benefit Depends On Income

You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040.

. You must also have a. 445 31 votes. Know Your Mortgage Options.

You can fully deduct home mortgage interest you pay on acquisition debt if. Web Here are the two major hurdles you have to jump over in order to take advantage of the mortgage interest deduction. Itemized Deductions to calculate your total deductions including your mortgage interest deduction.

Web You cant deduct the principal the borrowed money youre paying back. In addition to itemizing these conditions must be met for mortgage interest to be deductible. Web In this article well give you an overview of the mortgage interest deduction on your federal taxes.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web To deduct mortgage interest you need to fill out line 8a on Schedule A IRS Form 1040 or 1040-SR using Form 1098. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

If you are a single filer a married couple filing jointly or the leader of your household you could save money on the. Your lender will send Form 1098 to you. Web That means for the 2022 tax year married couples filing jointly single filers and heads of households could deduct the interest on mortgages up to 750000.

Web If your home was purchased before Dec. Web An equitable owner can deduct interest paid on a mortgage even if they are not directly liable for the debt. And lets say you also paid.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web Up to 96 cash back Used to buy build or improve your main or second home and. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

Secured by that home. Web At this time the ceiling is set at 750000. So lets say that you paid 10000 in mortgage interest.

Further mortgage payments and taxes. Web IRS Publication 936. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Youll enter your total itemized deduction on line 12 of. Here is an overview of.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web Use Schedule A. That means that the mortgage interest you.

Web You cant deduct home mortgage interest unless the following conditions are met. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtednessHowever higher. You must have secured debt.

Mortgage Interest Deduction How It Works In 2022 Wsj

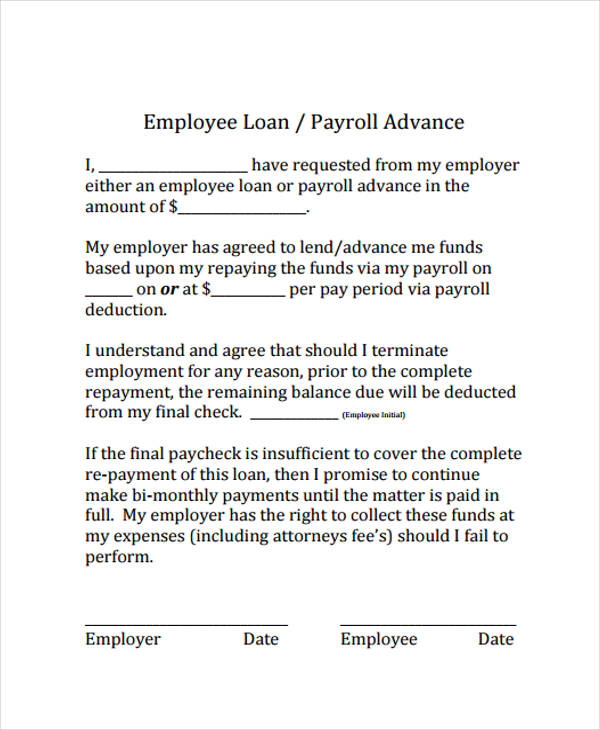

Free 65 Loan Agreement Form Example In Pdf Ms Word

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction A Guide Rocket Mortgage

What Is The Mortgage Interest Deduction The Motley Fool

How I Purchased My First Home At Aged 21 My Top Five Tips

Mortgage Interest Deduction How It Works In 2022 Wsj

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Tax Deduction Examples Pdf Examples

Maximum Mortgage Tax Deduction Benefit Depends On Income

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

M0q2ltuuwbbn5m

Finance Ibcanada Group

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction A Guide Rocket Mortgage

Latitude 38 November 2010